Industries And Inflation - Why The Rent Is Too Damn High

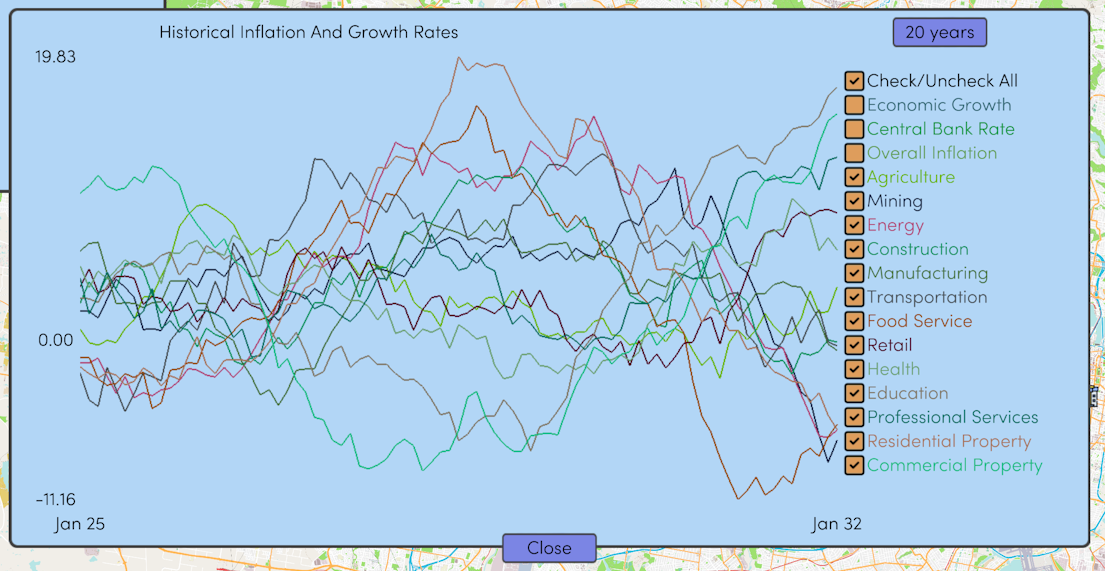

The economy in This Grand Life 2 is made up of industries. Each industry keeps track of its own inflation rate, which is how quickly prices are increasing or decreasing over time.

Almost every single price in the game is affected by a subset of these industries. Some examples:

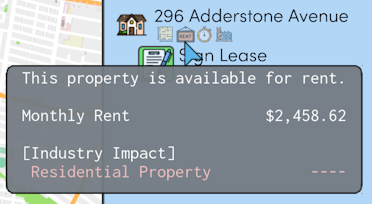

- House sale/rental prices affected by residential property industry

- Electricity bills by energy industry

- Delivery driver wages by transportation industry

- Groceries by agriculture and food service industry

- University/trade school fees by education industry

Items that perform similar functions can be affected by different industries as well, which plays into your decision-making.

For example, the price of a home fridge is affected by the retail and residential property industry (consumers spending money and buying new homes pushes up the price of fridges). On the other hand, the price of a commercial freezer is affected by the food service industry (more restaurants opening means higher demand for large freezers).

You can buy a commercial freezer for your home or a home fridge for your restaurant if you want, there are no restrictions. However the specific characteristics of each item affects its suitability.

A commercial freezer takes up a lot of space, uses more electricity and is more durable so would be better suited for the restaurant. However if the energy industry inflation rate is high (meaning high electricity bills), maybe you want to start your business with the home fridge until you actually need something bigger.

The inflation system can make for interesting decisions when combined with other gameplay mechanics. Some other choices that might crop up depending on the state of the economy are:

- Do you pursue the career best suited to your character's preferences, or get a job in a booming industry that's currently paying lots of money, even if your character hates the job?

- Should you buy a car, or use public transport instead if fuel prices are high?

- Should you wait for the education industry to crash before starting that expensive degree?

- Interest rates are low but the commercial property market is rising! Should you take out a loan, leverage yourself to the max and hope it all works out?

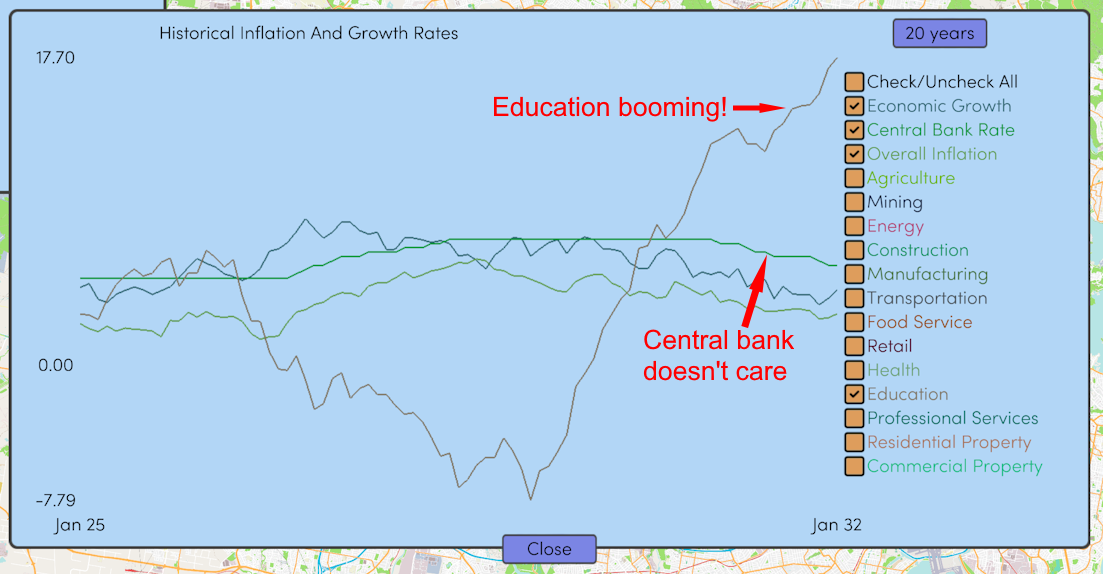

The central bank's role

All the individual inflation rates are combined into an overall inflation. The central bank looks at this overall inflation when deciding whether to raise or lower interest rates every month. In turn, this interest rate affects the cost/return on loans, mortgages or fixed interest investments you might have.

Since the central bank only looks at overall inflation, this means sometimes you'll have situations where a booming industry will get pushed even higher by central bank policy while the rest of the economy is doing poorly. It's just like some of the speculative bubbles we've seen recently in real life!

Get This Grand Life 2

This Grand Life 2

A money-focused life simulation with a deep economic system.

| Status | In development |

| Author | PokingWaterGames |

| Genre | Simulation, Role Playing |

| Tags | 2D, Economy, finance, Life Simulation, Management, Moddable, Modern, Strategy RPG, Tycoon |

More posts

- This Grand Life 2 launches into Early AccessJun 20, 2024

- Story Time - Mr. Jamali And His BarMay 25, 2024

- Design Talk - Deciding City PoliciesMay 15, 2024

- Managing Household Relations And Incompatible PersonalitiesMay 02, 2024

- The Schooling System And Teenage Mood SwingsApr 12, 2024

- Modding - Mafia Loans, Child Workers And MoreMar 21, 2024

- Early Access Date and Other AnnouncementsFeb 29, 2024

- Map Modifiers - Government Policy And Local IndustryJan 27, 2024

- Emergent Storytelling - The Life Of Paddy and LivDec 23, 2023

- Small Business (Part 3) - Building Awareness And ReputationNov 27, 2023

Leave a comment

Log in with itch.io to leave a comment.